In the fast-paced world of cryptocurrency trading, staying ahead of market trends can be challenging. This is where crypto trading bots come into play. These automated tools can execute trades for you, react to market movements in milliseconds, and operate 24/7 without the need for rest. But like any tool, the key to success lies in how you use it. Let’s dive into the best strategies for using crypto trading bots effectively to optimize your trading experience.

What are Crypto Trading Bots

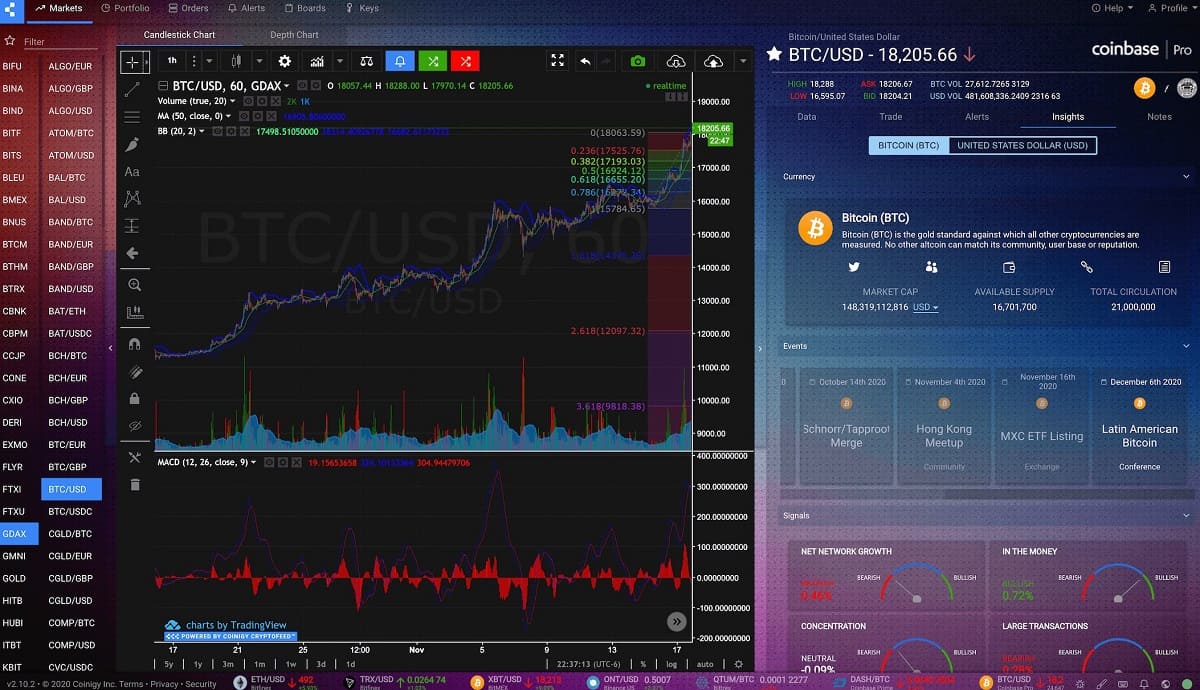

Crypto trading bots are software programs specifically designed to automate the process of buying and selling cryptocurrencies on your behalf. These bots can analyze vast amounts of data from the cryptocurrency market and, based on predefined strategies or algorithms, execute trades automatically without the need for direct human intervention. They monitor factors such as price movements, trading volume, technical indicators, and more, all in real-time. Crypto trading bots can be programmed to follow various strategies such as buying when prices are low and selling when they are high, or capitalizing on smaller market inefficiencies. The goal is to help traders maximize their profits while minimizing the time and effort spent on trading activities.

Why Are Crypto Trading Bots Popular in Today’s Market

The growing popularity of crypto trading bots in today’s market can be attributed to the increasing complexity and speed of the cryptocurrency landscape. Crypto trading bots have become indispensable tools for both novice and experienced traders because they allow users to participate in markets that are open 24/7. In a world where prices can fluctuate dramatically within seconds, speed is critical. Bots can execute trades within milliseconds, far faster than any human can. This makes them particularly valuable in highly volatile markets where reacting quickly to price changes can mean the difference between profit and loss.

Moreover, the use of bots has grown because they help eliminate the emotional aspect of trading. Human traders often make impulsive decisions based on fear, uncertainty, or greed, leading to inconsistent results. Bots, on the other hand, operate purely on logic and predefined rules. This makes them highly consistent and reliable, helping traders stick to their strategies without being influenced by short-term market fluctuations or personal biases. Additionally, bots can monitor multiple exchanges simultaneously, making them useful for traders who want to take advantage of price differences across various platforms. This increased efficiency, speed, and consistency are key reasons why crypto trading bots are now an essential tool in the cryptocurrency market.

Crypto Trading Bots

To use crypto trading bots effectively, it’s essential to understand the different types of bots, how they function, and the pros and cons associated with each. Not all bots are built the same, and they employ varying strategies to tackle the complexities of the cryptocurrency market. These bots are typically classified based on the strategies they employ, such as arbitrage, market-making, trend-following, and scalping. Each bot type is tailored to specific market conditions and trader goals, making it important for users to select the right one based on their trading objectives. A clear understanding of these bot types can help traders deploy them more effectively, ensuring they align with their overall trading strategy.

Arbitrage Bots

Arbitrage bots are designed to capitalize on price differences between different exchanges. Cryptocurrency prices can vary significantly across exchanges due to differences in liquidity and trading volume. An arbitrage bot identifies these price discrepancies and automatically buys the asset at a lower price on one exchange and sells it at a higher price on another. For example, if Bitcoin is priced lower on Exchange A than on Exchange B, the bot will buy Bitcoin on Exchange A and simultaneously sell it on Exchange B, making a profit from the price difference.

Key Advantages of Arbitrage Bots:

- Quick Profits: Arbitrage bots offer the potential for relatively fast gains, as they can exploit small price differences in real-time.

- Low-Risk Strategy: Since arbitrage bots execute trades across different platforms simultaneously, they mitigate market exposure and the risk associated with holding assets for long periods.

Potential Drawbacks of Arbitrage Bots:

- Execution Delays: While arbitrage opportunities exist, execution delays or exchange downtime can limit profitability.

- Competition: Many traders use arbitrage bots, which can lead to reduced opportunities as prices often converge quickly across exchanges.

Market-Making Bots

Market-making bots play a crucial role in providing liquidity to cryptocurrency markets. These bots continuously place buy and sell orders around the current market price, benefiting from the bid-ask spread. The goal is to earn small, consistent gains from the difference between the buy price (bid) and the sell price (ask) while facilitating smoother transactions for other traders. Market-making bots work best in stable or low-volatility markets where price fluctuations are not too extreme.

Key Advantages of Market-Making Bots:

- Consistent Returns: Market-making bots aim to generate small but regular profits by facilitating trades and taking advantage of the bid-ask spread.

- Market Liquidity: By placing buy and sell orders, market-making bots help provide liquidity to the market, making it easier for other traders to execute trades.

Potential Drawbacks of Market-Making Bots:

- Exposure to Market Movements: If the market moves sharply in one direction, the bot may incur losses by being caught on the wrong side of a trade.

- Requires High Trading Volume: Market-making bots are most effective in high-volume markets where spreads are consistently available.

Trend-Following Bots

Trend-following bots are designed to capitalize on market momentum by identifying and trading in the direction of prevailing trends. These bots analyze technical indicators and price patterns to determine whether an asset is experiencing an upward or downward trend. Once a trend is identified, the bot will enter a trade in the direction of that trend and exit when the trend shows signs of reversal or exhaustion. Trend-following bots work best in markets with clear, sustained trends.

Key Advantages of Trend-Following Bots:

- Profitable in Trending Markets: Trend-following bots can generate substantial profits when the market moves in a clear and sustained direction, either upward or downward.

- Adaptability: These bots can be adjusted to follow short-term or long-term trends, allowing for flexibility in different market environments.

Potential Drawbacks of Trend-Following Bots:

- Ineffective in Sideways Markets: Trend-following bots may struggle or incur losses in markets where there is no clear direction, as they rely heavily on market momentum.

- Delayed Reactions: Trend-following bots may enter or exit trades slightly after the trend begins or ends, resulting in suboptimal timing.

How Crypto Trading Bots Work

Crypto trading bots work by connecting to your cryptocurrency exchange account via API keys, which allow the bot to access your account and execute trades on your behalf. API (Application Programming Interface) keys act as the bridge between your exchange and the bot, enabling it to retrieve data like current prices, trading volume, and order book information. Once connected, the bot analyzes this data and uses predefined algorithms to make buy or sell decisions. The strategies embedded within the bot dictate how it responds to different market conditions, whether it’s a sudden price spike or a gradual decline. Once the bot identifies a trading opportunity based on its programmed settings, it automatically places the relevant trade orders within milliseconds. This rapid execution is what makes bots so valuable in volatile markets, where timing is critical.

Advantages of Using Crypto Trading Bots

Crypto trading bots offer numerous advantages for traders, especially in a market as dynamic and fast-paced as cryptocurrency. One of the primary benefits is speed. Bots can execute trades much faster than any human trader could. In volatile markets, the ability to react within milliseconds to sudden price changes can significantly impact profitability. Speed is particularly valuable for high-frequency trading strategies like scalping, where making small profits from tiny price fluctuations requires quick, precise actions.

Another major advantage is consistency. Unlike human traders who may be swayed by emotions such as fear, greed, or panic, trading bots follow predefined rules and strategies without deviation. This helps reduce the risk of impulsive decision-making that can lead to losses. Additionally, bots can operate continuously, 24/7, without fatigue. This ensures that opportunities are never missed, as the bot can trade during periods when human traders would normally be asleep or unavailable. The consistency and continuous operation of bots make them highly reliable tools in a trader’s arsenal, especially for those who seek to automate their trading activities.

Limitations of Crypto Trading Bots

While crypto trading bots provide numerous benefits, they also come with certain limitations. One of the key challenges is that bots are highly dependent on market data and cannot account for external factors such as major news events or sudden market shifts. For instance, a bot might be running smoothly based on historical data and technical indicators, but it may not be able to predict or react appropriately to unexpected events like government regulations or hacking incidents. This market dependence makes bots vulnerable to unforeseen circumstances that can cause significant price swings.

Moreover, although bots are automated, they still require regular monitoring and adjustments. The cryptocurrency market is incredibly volatile and can change rapidly. What may work well for a bot in one set of market conditions may not perform as effectively when the market shifts. Traders must periodically review their bot’s performance, adjust its strategies, and update its settings to ensure continued effectiveness. Additionally, some bots can be costly to use, whether due to high upfront purchase costs or ongoing subscription fees. Profits are not guaranteed, and improper setup or market conditions could result in losses that outweigh the benefits.

Maximizing Profits with Crypto Trading Bots

To maximize the profitability of your crypto trading bot, it’s important to remain actively involved in its performance and the trends of the broader market. While bots are designed to automate the trading process, they are not entirely set-and-forget tools. A crucial part of maximizing profits lies in consistently monitoring the bot’s performance and making necessary adjustments. Regularly evaluating how the bot is performing can help identify patterns or issues that may need addressing. For instance, certain strategies may work well during bullish markets but falter during bearish periods. By keeping a close watch on the bot’s behavior, you can make timely interventions that prevent potential losses and optimize gains.

Another important aspect of maximizing profits is staying informed about overall market conditions. The cryptocurrency market is highly volatile and subject to sudden, unexpected changes. Even the most sophisticated bot may struggle to keep up with extreme market swings unless it’s properly configured to do so. Traders should be prepared to adjust the bot’s settings to adapt to new market conditions, whether that means tightening risk parameters, changing the bot’s trading strategy, or temporarily pausing its activity during highly unstable periods. Staying engaged with both the bot’s performance and the broader market landscape can significantly enhance profitability.

|

Feature |

Explanation |

Advantages |

Limitations |

|---|---|---|---|

|

How Bots Work |

Connect to exchange via API keys, analyze data, and execute trades based on predefined strategies. |

Speed, 24/7 trading, emotionless execution. |

Dependent on market data, requires monitoring. |

|

Speed |

Bots can execute trades faster than humans. |

Faster reactions in volatile markets. |

May miss nuances of complex market changes. |

|

Consistency |

Bots follow strategies consistently without emotional interference. |

Reduces emotional trading mistakes. |

May struggle with unpredictable market conditions. |

|

24/7 Operation |

Bots operate around the clock. |

Never miss a trading opportunity. |

Requires regular maintenance. |

|

Market Dependence |

Bots rely on market data to function effectively. |

Can make trades based on real-time data. |

Cannot predict external factors like news events. |

|

Need for Monitoring |

Bots require oversight to ensure correct operation. |

Helps optimize bot performance through adjustments. |

Monitoring can be time-consuming. |

|

Cost |

Some bots come with a high price tag. |

Can potentially increase profitability. |

No guarantee of profits, cost may outweigh gains. |

MonitoringBot Performance Regularly

Even though crypto trading bots automate much of the trading process, regular monitoring is essential to ensure they are functioning correctly and efficiently. The performance of trading bots can vary depending on numerous factors, including market volatility, changes in trading volume, and the overall economic landscape. For this reason, it’s important to check the bot’s activities regularly to ensure that its algorithm is still aligned with current market conditions. Regular monitoring allows you to identify whether the bot is still making profitable trades or if adjustments need to be made to its strategy.

Adjusting Strategies Based on Market Conditions

The cryptocurrency market is notorious for its volatility, with prices often swinging drastically within short periods. This volatility presents both opportunities and risks for crypto trading bots. While bots can react to market conditions within milliseconds, the success of their strategies largely depends on the market environment. For instance, a bot designed for trend-following may perform well in a market with clear upward or downward trends, but it might struggle in a sideways market where price movements are less predictable. Adapting the bot’s strategy to the current market conditions is crucial for maintaining profitability.

Traders need to be flexible and willing to adjust their bot’s settings to align with the prevailing market trends. This may involve switching between different strategies, such as moving from trend-following to scalping during periods of high volatility. By being proactive and adjusting the bot’s strategies based on market conditions, traders can enhance the bot’s performance and reduce the likelihood of significant losses. It’s important to stay informed about market movements, economic news, and technical indicators to ensure that your bot is always positioned to take advantage of favorable conditions.